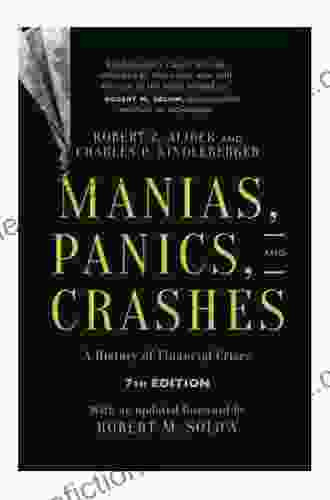

History of Financial Crises Seventh Edition: A Comprehensive Exploration

4.2 out of 5

| Language | : | English |

| File size | : | 1876 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 442 pages |

Financial crises are pivotal events that have shaped the world of finance and investing. They expose the vulnerabilities of financial systems, test the resilience of economies, and leave lasting scars on individuals, businesses, and nations. Studying the history of financial crises provides valuable insights into the causes, consequences, and lessons learned from these tumultuous events.

This comprehensive guide presents the seventh edition of the History of Financial Crises. It delves into some of the most significant financial crises in history, providing detailed accounts of their origins, key events, and aftermath. By examining these past crises, we aim to empower investors with the knowledge and understanding necessary to anticipate and navigate future financial challenges.

Chapter 1: The Tulip Mania (1636-1637)

The Tulip Mania, one of the earliest recorded financial crises, occurred during the Dutch Golden Age. Tulip bulbs, particularly rare and exotic varieties, became highly sought after as speculative investments. The unprecedented demand led to astronomical prices, creating a bubble that eventually burst. This crisis highlights the dangers of speculative investing and the importance of valuing assets based on their intrinsic worth.

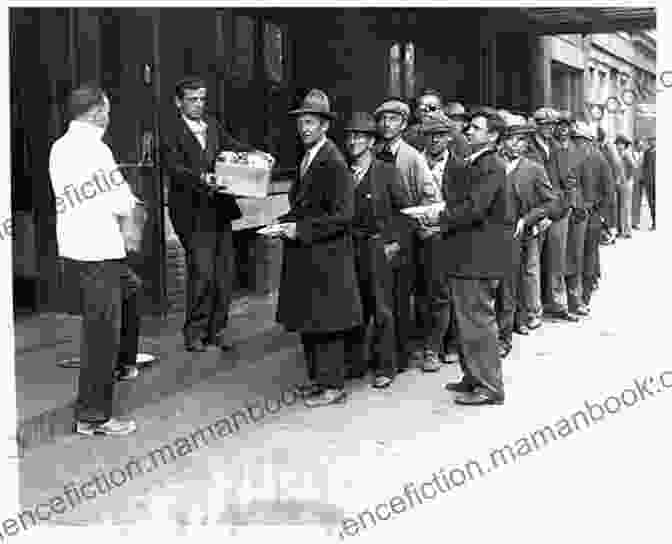

Chapter 2: The Great Depression (1929-1939)

The Great Depression was the longest, deepest, and most widespread economic downturn in modern history. Triggered by the stock market crash of 1929, the crisis led to widespread unemployment, bank failures, and economic collapse. This chapter examines the factors that contributed to the Great Depression, including monetary policy mistakes, excessive risk-taking, and global economic imbalances. It emphasizes the importance of sound financial regulation and prudent fiscal policies.

Chapter 3: Black Monday (1987)

Black Monday, October 19, 1987, witnessed the largest one-day percentage decline in stock market history. A combination of factors, including algorithmic trading, market overvaluation, and lack of market circuit breakers, contributed to the dramatic sell-off. This chapter analyzes the events leading up to Black Monday, the impact on investors, and the lessons learned about risk management and market volatility.

Chapter 4: The 2008 Global Financial Crisis

The 2008 Global Financial Crisis, often considered the worst financial crisis since the Great Depression, was triggered by the collapse of the subprime mortgage market in the United States. This crisis spread to the banking system, credit markets, and global economy, causing widespread financial instability and economic recession. This chapter examines the key factors that led to the crisis, including subprime lending, securitization, and lack of regulatory oversight.

Chapter 5: Lessons Learned and Investment Strategies

The final chapter synthesizes the lessons learned from past financial crises and provides practical investment strategies for navigating future crises. This chapter highlights the importance of diversification, risk management, and prudent financial planning. It emphasizes the need for investors to understand the risks and rewards of various asset classes and to invest with a long-term perspective.

The History of Financial Crises is a valuable resource for investors, financial professionals, and anyone seeking to understand the complex world of finance. By examining the mistakes and successes of the past, we can better prepare for and mitigate the risks associated with future financial crises. This comprehensive guide provides the insights, knowledge, and investment strategies necessary to navigate these turbulent events and emerge stronger as investors.

4.2 out of 5

| Language | : | English |

| File size | : | 1876 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 442 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Bertram C Bruce

Bertram C Bruce L V Lane

L V Lane Jane Tyson Clement

Jane Tyson Clement Sheila Kilbane Md

Sheila Kilbane Md Ben Macintyre

Ben Macintyre Jacquelynn Luben

Jacquelynn Luben Edward Willett

Edward Willett Ee Isherwood

Ee Isherwood Donald Crane

Donald Crane Yamen Manai

Yamen Manai Ann Tusa

Ann Tusa Sade L Collins

Sade L Collins Angela Franks

Angela Franks Kai Strand

Kai Strand Michael Roberts

Michael Roberts Paul Hoover

Paul Hoover Dr Anthony M Criniti Iv

Dr Anthony M Criniti Iv Lena Greiner

Lena Greiner Celeste Corey Zopich

Celeste Corey Zopich Simon Child

Simon Child

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Rudyard KiplingFollow ·17.8k

Rudyard KiplingFollow ·17.8k Tom ClancyFollow ·8.7k

Tom ClancyFollow ·8.7k Marc FosterFollow ·19.8k

Marc FosterFollow ·19.8k Felix HayesFollow ·7k

Felix HayesFollow ·7k Gil TurnerFollow ·19.4k

Gil TurnerFollow ·19.4k Hugo CoxFollow ·3.1k

Hugo CoxFollow ·3.1k Aleksandr PushkinFollow ·11.2k

Aleksandr PushkinFollow ·11.2k John KeatsFollow ·16.5k

John KeatsFollow ·16.5k

Ashton Reed

Ashton ReedClean(ish) Food for People Who Like to Eat Dirty

By: [Your Name] Are...

Ronald Simmons

Ronald SimmonsThe Handbook for Educators: A Comprehensive Guide to...

The Handbook for...

Derrick Hughes

Derrick HughesAny Place Hang My Hat: A Hauntingly Beautiful Novel by...

A Masterpiece of...

Adrien Blair

Adrien BlairFly Me to the Moon Vol. 5: A Lunar Odyssey through...

In the vast...

William Powell

William PowellTips By Gardeners On Variety Of Subjects

Gardening...

4.2 out of 5

| Language | : | English |

| File size | : | 1876 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 442 pages |